Mountstone Partners create and manage bespoke investment portfolios for wealthy families, charities and trusts. CEO James Keen publishes a monthly investment update for their clients. Here is James Keen’s November Newsletter – please contact him if you have any queries about the markets or indeed the portfolio.

The healthcare sector has been booming over the last few years because of the success of new drugs being brought to the market, greater pricing power for drugs companies and a significant shift in demographics towards the elderly. In other words demand and supply have increased at the same time that prices have been pushed higher.

However at least one of those factors may be about to come under pressure – prices. Hillary Clinton promised to curb aggressive price hikes by pharmaceutical companies if elected president, after some aggressive price raising tactics from the likes of Turin Pharmaceuticals hit the headlines and outraged consumers. The sector has plummeted recently as a result.

This month we look back at the performance of the healthcare sector and consider its future. We assess the key reasons for the success story thus far and examine the significance of Mrs Clinton’s promise to curb price increases. Finally we look at the future prospects for what has been a very profitable sector for us over the past three years.

Hedge fund managers have generally been the subject of some pretty bad press over the past few years but not many have attracted such vitriol as the former hedgie turned Turing Pharmaceuticals CEO, Martin Shkreli. His decision to hike the price of a 62 year-old drug, Daraprim (used to treat parasitic infections), from $13.50 to $750 per pill overnight made him a household name for the wrong reasons. There was an immediate public backlash which culminated in, amongst other things, Hillary Clinton pledging price controls on drugs companies if she were to win the mandate for the Whitehouse. The healthcare sector plummeted in reaction to the news.

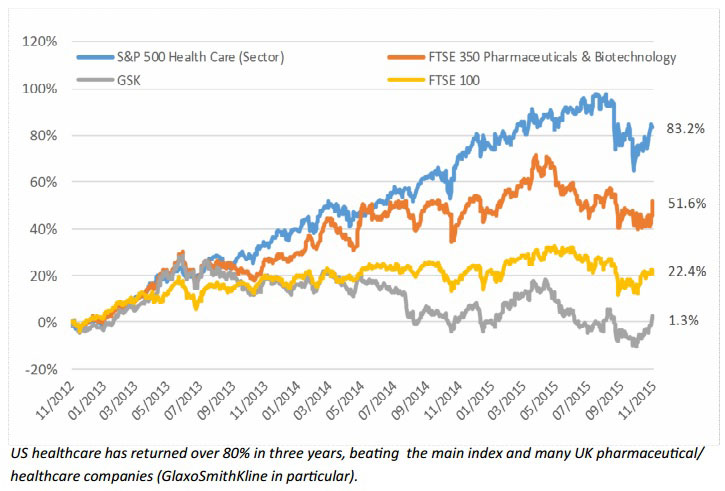

Despite Shkreli’s actions our weighting to healthcare has proven to be one of best performing sectors over the past three years. Over that time the US healthcare index has risen 83.2% and whilst some of the old stalwarts of the FTSE100 such as GlaxoSmithKline (+1.3%) have not participated in the rally our stance of investing into broader international thematic funds has paid dividends, with the likes of the Polar Capital Healthcare Opportunities fund significantly outperforming the US index (+123.72%).

However given the recent political wrangling and subsequent in- crease in volatility that the sector has been exposed to, this month we have reviewed our original thesis for investing in healthcare and consider whether or not it still stands out as an attractive theme.

So firstly why has the healthcare sector performed so well up to now? In our view there are a few major reasons:

- The significant rise in the number of products that the smaller Biotech firms have brought to market whilst Glaxo and Astra have been relatively quiet on this front

- Pickup in Merger and Acquisition (M&A) activity as the larger drug companies look to acquire some smaller companies withinteresting pipeline

- Revolutionary therapies have driven revenues higher thus making share prices relative to company earnings look very attractive

- Huge demographic changes in developed market countries

Gilead Sciences is a good example of a company that encapsulates much of the above. In 2011 they acquired Pharmasset for $11bn, an announcement that drove the stock price 9% lower. However since then the success of Pharmasset’s hepatitis drug and the seven alternate drugs that they have brought to the market have more than tripled their revenues from $9.7bn in 2012 to a forecasted $33bn this year. As a result of this ambitious M&A strategy, with a market capitalisation of $155bn Gilead is now the 25th biggest company in the US and almost as large as both AstraZeneca and GlaxoSmithKline combined.

There are many other examples of successful M&A activity in the sector over the last few years and earnings have been growing strongly and consistently as a result of economies of scale. However despite the general improvement in earnings forecasts, Mr Shkreli at Turing’s actions proved the catalyst for a period of profit taking, resulting in the healthcare sector being one of the worst performing sectors in the recent equity market sell-off. Indeed at times it was only the energy and mining sectors, which are in the midst of secular bear markets caused by slowdown in China, which were faring worse.

Whilst Turing only has one drug, it was the political reaction to the price increase which affected the wider sector so badly. Hillary Clinton tweeted criticism of the company and wider industry as soon as she heard about the price hike and has since announced the inten- tion to control price increases if she wins the presidential election. It is a subject that has been top of her agenda for some time and she was a chief proponent of Bill Clinton’s health security act which pro- posed reforming the healthcare system so that all Americans were guaranteed comprehensive health coverage. Her policies in the run up to the 2008 election were the basis of much of what became known as ObamaCare.

Given Hillary Clinton’s staunch views and the fact that healthcare is the leading cause of long-term US public debt, the subject has become a key topic for all presidential candidates and is likely to cast a shadow over the sector in the run up to the election this time next year. However, we expect that this major political posturing will prove to be underwhelming, as it is unlikely given the high level of Republican representation in US Congress that a Democrat (Hillary Clinton is currently odds on favourite) will be able to push through any legislation surrounding drug pricing without support from the other side of the house.

Whilst these political actions have understandably affected sentiment, the ferocity with which healthcare was sold-off in September surprised many. What has become apparent is that many generalist investment funds and hedge fund managers had built up significant overweight positions in the sector, most notably in Biotech. Therefore when the sell-off began it was fairly indiscriminate and ignored many of the fundamentals surrounding the earnings or valuations of the individual stocks involved.

One hedge fund manager who has built up significant exposure to the sector is Bill Ackman, manager of Pershing Square Holdings. Frus- tratingly, exposure to one stock that is heavily linked to price hiking concerns (Valeant Pharmaceuticals) has led to a significant fall in the Pershing Square share price over the past month. They have consistently updated shareholders on their stance with regard to Valeant and we are closely monitoring events to determine if a recovery in Pershing Square, as we have seen in the wider sector, is likely.

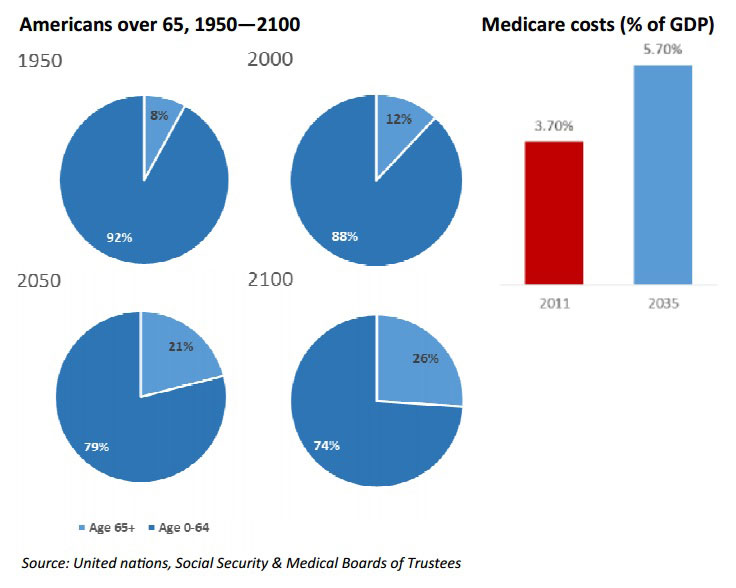

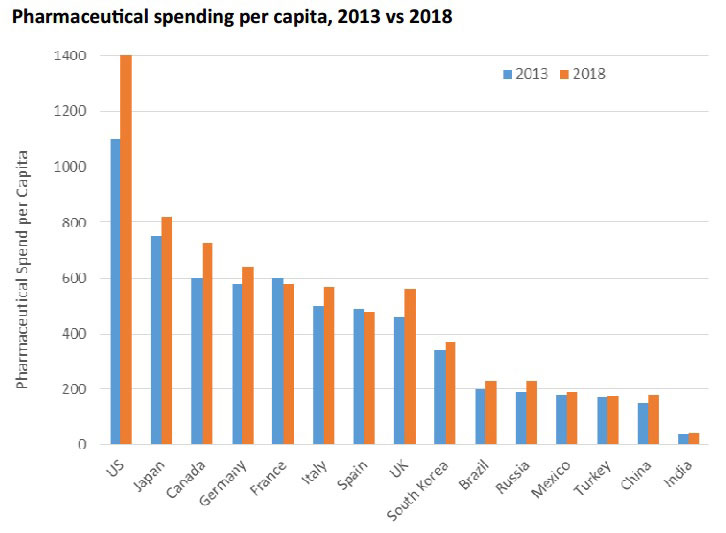

What is very clear for the healthcare sector is that over the next 20 years we can expect rising prices of healthcare provision and rising per capita expenditure on pharmaceuticals. By 2035 US Medicare costs are forecast to grow from 3.7% of US GDP to 5.7%, equating to an increase of $348bn. This is primarily the result of an ageing population rather than a superior health system. For instance in 2011 the US ranked 38th in the world in life expectancy and preventable medical mistakes/infections were the sixth leading cause of death in the country.

The US does not find itself in a unique position with regard to an ageing population as most developed countries are facing up to this same issue. If you strip out China and India from the equation, the United Nations are forecasting fairly stable population growth in the G7 economies, however the working age population is likely to reduce by an average of 7.33% between 2010 and 2040 (albeit a continuation in the recent migration within Europe could affect this). The healthcare sector will prove to be a significant beneficiary of this ageing population as individuals tend to spend an increasing proportion of their annual expenditure on healthcare as they grow older.

We are of the view that the healthcare bull market still has some way to run. The innovation cycles are very long and we have only witnessed a small proportion of the Research and Development (R&D) productivity improvements from the pharmaceutical, Biotech and medical device companies over the past few years. In 2014 a record 61 new drugs were introduced around the world (against an average of 34 in the last decade) primarily as a result of the benefits associated with scientific advances triggered by the sequencing of the human genome15 years ago.

The success of companies bringing these new drugs to market has led to a significant increase in the level of M&A in the sector over the past few years and we expect that this trend will continue to lend support to share prices. In the first six months of this year there were $221bn worth of pharmaceutical deals completed, a 300% increase over the same period in 2014. As highlighted earlier some of the larger pharmaceutical companies have significantly reined back their R&D spend over the past 20 years, which led to them becoming very reliant on a smaller number of blockbuster drugs whose patents were expiring. Whilst they don’t have the pipeline drugs they do still however have the skills to commercialise the new drugs that Biotech firms are producing and as such (contrary to a large proportion of M&A deals) many of the deals completed in this sector should prove beneficial for both parties and the end consumer. Indeed, a great irony for Gilead is that because they have been so successful at marketing their Hepatitis C drug, they may struggle to find new patients who require it in the future. Great news for consumers and an encouraging development for current patients.

The sector has suffered an increase in volatility through the summer and whilst it is likely to remain volatile in the run up to the US election we continue to believe in the long-term fundamentals for healthcare as a sector. This is because demand will only increase due to demographic changes in the developed and ultimately the developing worlds. In addition superior medical testing and enhanced research provide a favourable backdrop for the sector over the longer term as drugs become cheaper to produce and quicker to market. This means that both demand will be very high and that supply should be increasingly efficient. Therefore regardless of the current pricing issue, even if margins for healthcare companies were to fall, significant volume increases will help to protect and probably grow revenues over the decades ahead. This should be good news for investors in the sector.

Mountstone Partners Ltd

7-8 Henrietta Street

Covent Garden

London

WC2E 8PS

James Keen – Director

James is co-founder of Mountstone Partners and is responsible for managing client portfolios, chair of the asset allocation committee and has oversight of the portfolio construction process.

James is co-founder of Mountstone Partners and is responsible for managing client portfolios, chair of the asset allocation committee and has oversight of the portfolio construction process.

Prior to founding Mountstone, James was an Investment Director at Brooks Macdonald, a firm that manages £4.5 billion of private client portfolios. At Brooks Macdonald James was one of 3 Investment Committee members responsible for the entire investment process. He was an Asset Allocation Committee member, head of 5 London investment teams and was responsible for client relationships representing £239 million of client portfolios.

James has been recognised as one of the “Top 40 Under 40” advisers in wealth management in the UK (as awarded by PAM) for the last 2 years running